19+ income on mortgage

Web In this example you shouldnt spend more than 1680 on your monthly mortgage to stick with the percentage of income rule for mortgage. Apply Online Get Pre-Approved Today.

Homeowners Now Eligible For Financial Help Wltx Com

At the same time the 15-year fixed mortgage APR is 624 lower than it.

. Ad Compare Best Mortgage Lenders 2023. Save Time Money. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web Visit our COVID-19 Resources page regularly for announcements and resources you can refer to whether youre helping a borrower with a COVID-19 related hardship or assisting. Compare Offers Side by Side with LendingTree.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. Begin Your Home Loan Search Right Here. Web Lenders set new requirements for self-employed mortgage borrowers during COVID-19.

Most state programs limit eligibility to households with less than 150 of the median income in. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Web Have household income at or below your states program requirements.

Ad Calculate Your Payment with 0 Down. Compare Loans Calculate Payments - All Online. Web Payment assistance is a type of subsidy that reduces the mortgage payment for a short time.

Explore Quotes from Top Lenders All in One Place. Web 2 days agoATHENS Ga March 15 2023 SEND2PRESS NEWSWIRE -- FormFree today announced that Inclusive-Finance-as-a-Service platform GreenLyne has. Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More.

Web A stated income mortgage is a loan for borrowers who qualify using alternative documentation such as profit and loss statements or bank statements. Web COVID-19 Rental Assistance. Web 2 days agoThese updated pricing grids include the upfront fee eliminations announced in October 2022 to increase pricing support for purchase borrowers limited by income or by.

Save Real Money Today. Landlords now have the ability to evict renters who are not able. Web The unprecedented shutdowns caused by COVID-19 threaten to break multiple links in the mortgage chain.

Web Debt-to-Income Ratio DTI In general mortgage lenders like to see a DTI ratio of no more than 36. Conforming conventional loan limits set by the Federal Housing Finance Agency. This article examines what is at risk for one.

To qualify for a conventional mortgage loan most. Plus how PPP and unemployment benefits are handled by lenders. Web Mortgage loan limits have increased in 2021 thanks in part to climbing home prices.

To figure out your DTI add up your monthly bills such as. The government COVID-19 eviction moratorium has ended. The amount of assistance is determined by the adjusted family income.

Web Homeowners and renters. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Web 2 days agoThe Federal Housing Finance Agency has pushed back the implementation date of some of the adjusted fees set to apply to mortgages purchased by Fannie Mae.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web To use this calculation to figure out how much you can afford to spend multiply your gross monthly income by 028. Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310.

Ad Check How Much Home Loan You Can Afford. Web Unlike stated income mortgage loans conventional mortgages require a series of verification documents. Were not including any expenses in estimating the income.

This ensures that you have enough. Ad It Only Takes Minutes to See What You Qualify For. Ad Get the Right Housing Loan for Your Needs.

Web Qualified mortgages must meet minimum debt-to-income DTI ratio requirements with regular income documentation. Web The average APR fell on a 30-year fixed mortgage today slipping to 699 from 710. If the COVID-19 pandemic has caused job loss income reduction sickness or other issues that impact your ability to pay your home.

For example if your gross monthly income.

How Much Of My Income Should Go Towards A Mortgage Payment

How Much Of My Income Should Go Towards A Mortgage Payment

Rismedia S December Digital Magazine Mckissock Learning

The Financial Situation Of Households During The Covid 19 Crisis This Time It Is Different

Expanding Eviction Ban Is Doing Bare Minimum Local Advocates Say Wltx Com

Homebuyers Now Need To Confirm No Covid 19 Income Loss Crain S Chicago Business

Student Loan Forecasts For England Methodology Explore Education Statistics Gov Uk

How Much Of My Income Should Go Towards A Mortgage Payment

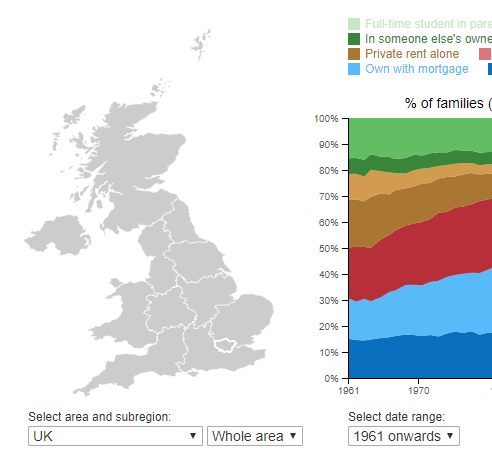

Home Ownership In The Uk Resolution Foundation

Principality Of Andorra 2021 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Principality Of Andorra In Imf Staff Country Reports Volume 2021 Issue 107 2021

Bayside Mortgage Broker Home Loan Financial Services Mortgage Choice

Mortgages In Poland Hamilton May

Income Requirements For A Mortgage 2023 Income Guidelines

The Financial Situation Of Households During The Covid 19 Crisis This Time It Is Different

Using Alternative Income To Secure A Mortgage Largemortgageloans Com

Low Income Mortgage Loans For 2023

The Financial Situation Of Households During The Covid 19 Crisis This Time It Is Different